Has Uber driven off the road in India?

Or its just a detour !

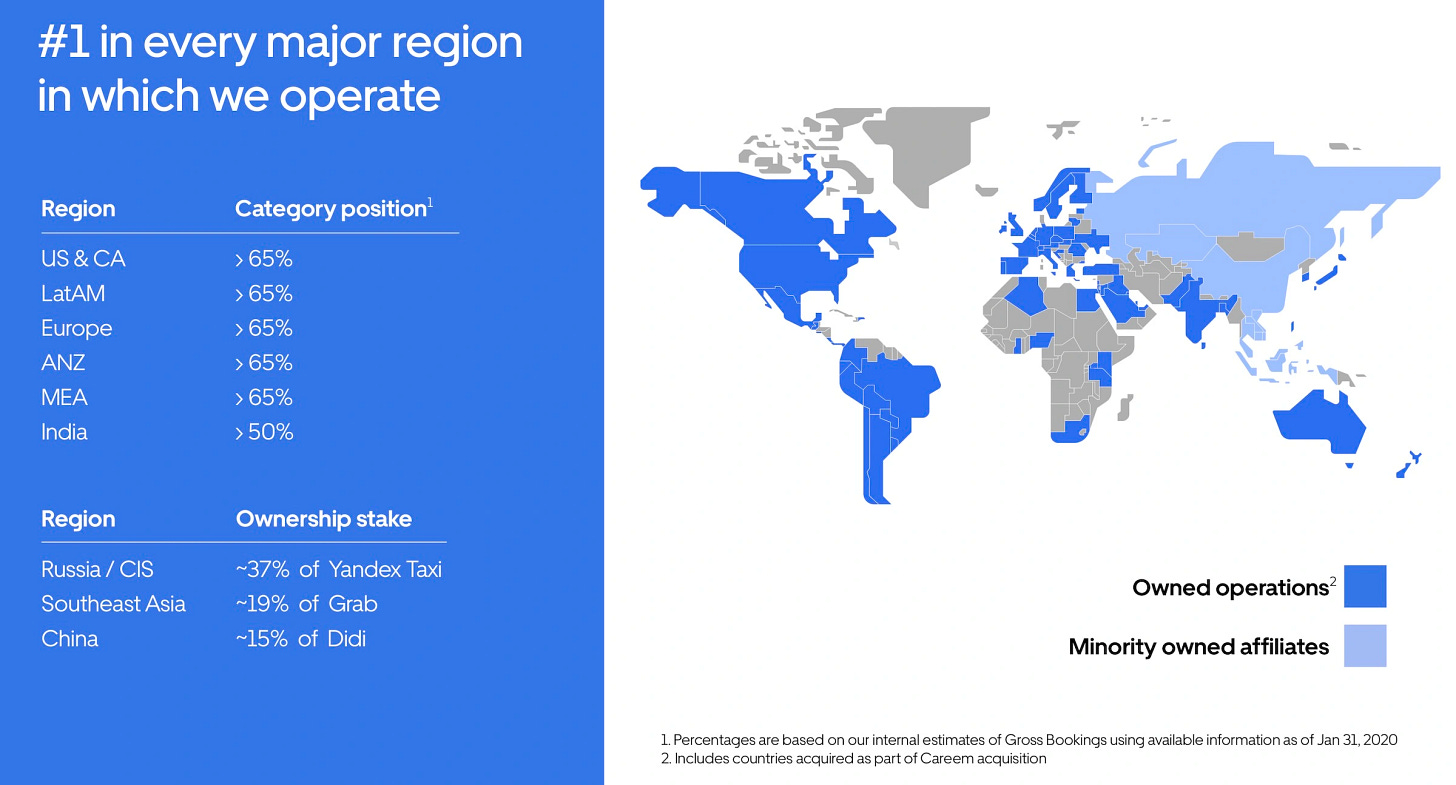

Uber is the largest ride hailing company in the world and has a presence in 72 countries and 10,000 cities. It is a monopoly or an oligopoly wherever it runs.

Source: Uber Investor Presentation, 2022

What is the scale of their business

In 2021, Uber did over 17 Million trips a day (worldwide) which equals 6.2 Billion rides in the full calendar year which is almost equal to the world’s population :)

What is the room for growth

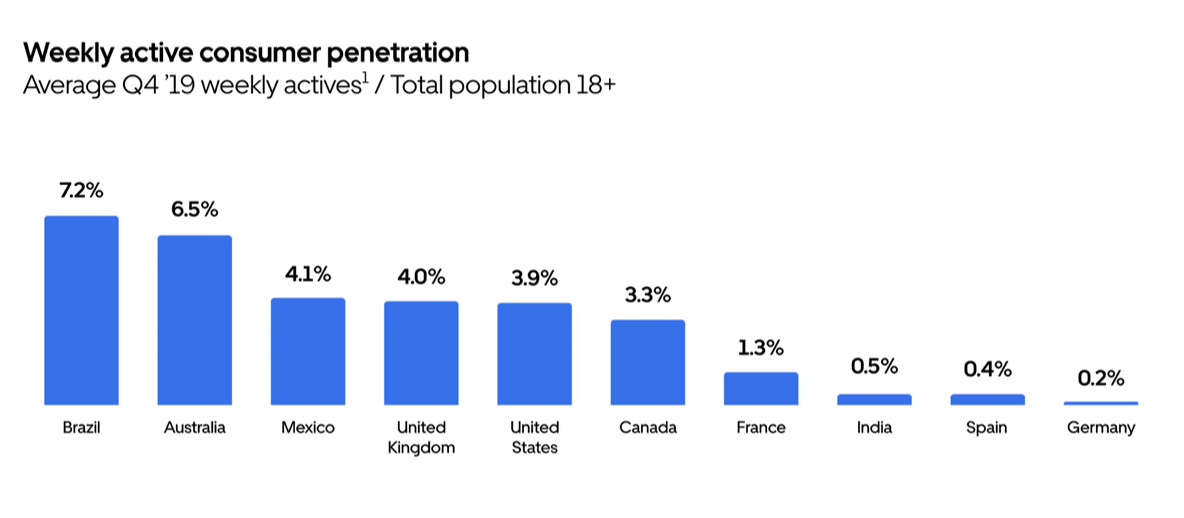

Even though the scale is pretty steep - the growth or the demand has not tapered off at all. In fact, there is a significant headroom for growth. A good way to look at the headroom for growth is to look at the current penetration in different markets. The best data that I could get on penetration was the weekly active consumers as a % of the 18+ population in the country (which is not a highly efficient metric to check penetration as it assumes that the whole 18+ population is addressable market).

But still if we look at the data - Uber has achieved 4%+ penetration in a number of countries including Developed countries like US and UK and developing countries such as Brazil and Mexico. This provide a significant headroom in big markets especially India.

Source: Uber Investors Day 2022 Presentation

Why do people use Uber (both Supply and Demand)

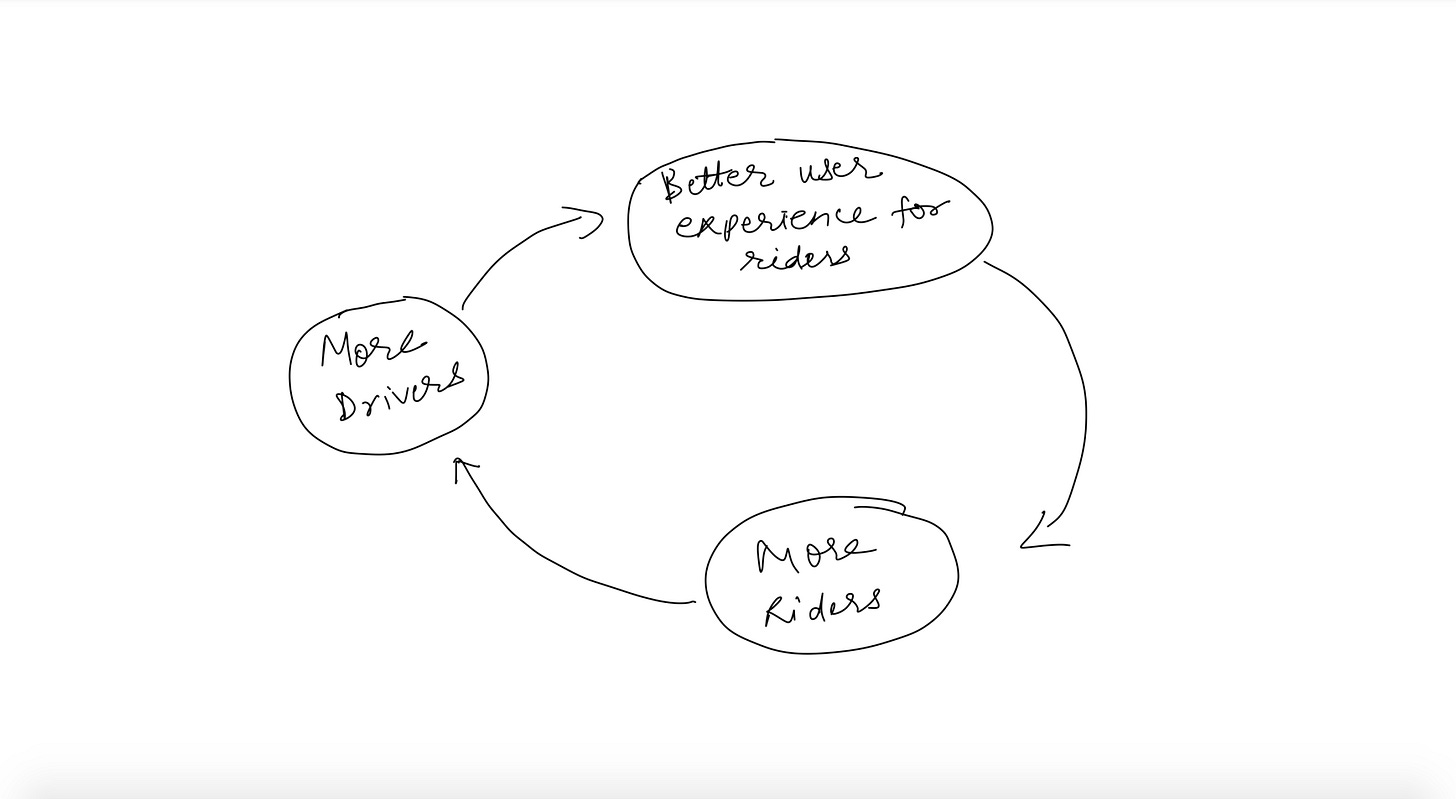

First lets dive into the raison d'etre for Uber. Essentially, Uber is a two sided marketplace where it matches drivers with passengers.

There are a number of use cases for the passenger:

Corporate intracity travel: Corporate employees use Uber to travel from Home to Office and vice versa or for going to various client meetings. This demand is cramped between a few peak hours during the day (essentially 8 AM to 10 AM and 5 PM to 8 PM in India) and there is no demand on weekends. So, this demand needs to be aggregated with some other demand to keep the driver busy and give them enough trips during the day. However, majority of this demand is paid for by companies so price sensitivity is less.

Airport/Train Drop/Pickups: People going to or coming back from airports and railway stations need a reliable and consistent experience. Uber solves both of these elegantly. This is also a strong use case with good value addition for the users. Competing cheaper alternatives are much less attractive (being dropped/picked up by a family member). Travel (Airport transfers) is also peak hours based (early morning and late night) but it juxtaposes well with Office demand to create a better pipeline of work for the drivers.

Leisure travel: Uber is used by families for going from Point A to Point B or by sub families. An interesting use case (in India at least) is Uber being used by family members who do not know driving (mostly wives, young children and parents) - giving independence to them (which is a great value add till the quality of service remains good) and frees up the driving members of the family (mostly earning male members).

What are the use cases for Drivers

There is essentially one motivation here which is that it would help them earn good money after accounting for the fuel and EMI cost. And mind you - EMI is a fixed cost and would be applicable whether they work with Uber or not.

Uber’s Success metrics

Uber’s success depends on the following metrics:

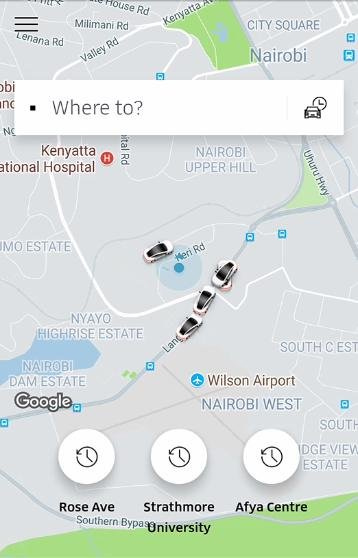

Driver density in a particular area: For the consumer, it does not matter whether Uber operates in 10,000 cities or is present only in her city or whether it has 1 Million drivers worldwide or only 100 drivers. What matters to the user is - “How much time does an Uber takes to arrive after she has booked a cab” and that solely depends on the number of car icons that she can see in the vicinity of her location (meaning within 2-3 kms of driving distance) when she is booking the cab.

Customer Density in a region: For driver to have enough and more trips during the day, there needs to be enough liquidity of customers looking to hire a cab in driver’s city.

These two above points, essentially, are basic metrics for any two sided marketplace - liquidity on demand and supply side.

The liquidity on both sides, though, lead to the following two metrics which the marketplace participants (driver and passenger) care about.

Profit per day for the driver: Driver is looking to earn a minimum amount of money after deducting the variable costs (fuel cost, Uber commission and maintenance) and the fixed costs (EMI of the car). If the platform enables the driver to earn that minimum daily threshold then he sticks to the platform and contributes to Point 1 (enough driver liquidity in the region). This metric depends on the number of kms driven during the day and amount charged per km to the customer.

Cost per Km for the user: This is mostly a derived metric and depends on the first 2 points. Higher the driver density in an area - lower is the distance travelled by the driver to reach the pickup point and lower is the time wasted for both driver and passenger. Higher the customer density in an area - more are the number of trips done during the day and the fixed costs (aka EMI) amortise over higher trips meaning that the driver can afford to charge a lower cost per km and still make good money. However, cost per km need to be low in addition to customer experience being smooth.

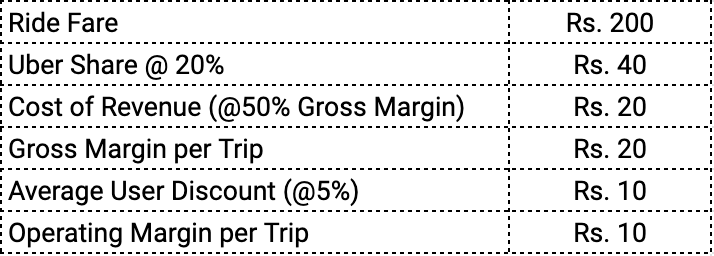

Unit Economics

If we look at Unit Economics - then for 2021, Gross Margins were around 46% and then there are four more costs which are not fully variable. Operations and Support (1.9 Bn USD), General and Administrative (G&A - 2.3 Bn USD), Research & Development (R&D - 2 Bn USD) and Sales and Marketing. Out of these First three - Ops, G&A and R&D are mostly fixed in nature and have stayed constant or reduced during 2021 in spite of a 50%+ increase in revenue. Sales and Marketing is correlated to Revenue to a certain extent. Putting Sales and Marketing also as a % of Revenue - it is around 30% of the revenue.

Now looking at the Unit Economics at a trip level

Average trip is around USD 15 fare for the passenger. Uber’s share of revenue from the trip is around 20%.

If we look at these numbers at a trip level -

So Uber needs to double its current scale to break even and mind you - this growth needs to come from the same cities or else the fixed costs would increase as Uber would need to hire more city specific teams.

Coming to Uber’s India Operations

Uber handled 11 Million rides a week in India in 2018 and claimed to be having over 50% and less than 65% market share in the country (to keep calculations simple - say actual is 55% then the overall market was 20 Million rides a week. With the pandemic in 2019, 2020 and 2021; the numbers are still reeling under COVID so it is safe to assume that India’s ride hailing market is still at a similar level of 20 Mn odd rides per week or ~ 1Billion rides a year.

Uber also claims 0.5% penetration amongst population above 18 years (meaning 0.5% of ~100 crore - 50 lakh). Essentially, Uber is being used by 50 lakh to 1 crore people in India and it is used on an average once a week by these users (actually it is once every 2 weeks as you would end up doing two trips most of the times - coming and going). A chunk of these users would be power users and must be using it even more (like I was before the pandemic - using is 30-40 times a month).

How Uber India built its supply side density

When Uber started out in India - it doled out super normal incentives to the drivers wherein they were given good money for achieving certain targets. For Example: I had heard a number of drivers mentioning that they need to complete X number of Uber trips during the day to get a weekly incentive as high as Rs. 4000-10000. What it essentially did (in addition to burning a hole in Uber’s PnL) was that new drivers signed onto Uber network and also were disincentivized to work for both Uber and Ola at the same time.

That initial time was gala time for the drivers as they were making very good money every month but as they said “There is no free lunch” so Uber ultimately took those incentives away (once it was sure that the network was built and supply side was set). Now, the drivers were still making good money (compared to what they were making in Pre Uber era) but their satisfaction levels with Uber were low.

Pandemic broke the back of drivers as well as Uber as all mobility demand went back to zero for months. And even after the cities were opened up - corporate travel is still very low as Work from Home Concept has taken vogue in all major cities such as Gurgaon, Bangalore and Hydrabad. This has essentially broken the Point No 2 of success metrics (Enough profit per day for the drivers) and kinda leading to falling dominoes on the demand side experience (aka cancelled trips, long wait times and bad driver behaviour | as they don’t care about Uber network as much as they used ti=o value it earlier).

How Uber India built its demand side

Uber’s service always had a demand - it was being fulfilled by the local Taxi operators and Meru also joined in much before Uber.

Uber got some of this demand attracted to its network by giving much better user experience at a lower cost. I still remember calling Meru on their hotline number to book a cab in 2000s. Meru’s cost was much higher than what Uber/Ola offered; in fact, Meru’s cost today is also 15-20% higher than Uber.

So Uber gave a better product at lower cost and spent heavily on alliances, marketing and user discounts to kickstart the demand flywheel which was essential to keep supply engaged.

Most of the user discounts offered during this era were around first few trips - Example “Get Rs. 75 off for first three trips” which essentially meant a zero cost short trip. People used it and some of them sticked to the experience.

This stronger demand fed into the flywheel of getting more and more drivers on board.

Unit Economics in India for Uber

* These are Guesstimates based on my best judgement

Here, 50% Gross Margin has been sourced from Uber’s world wide Gross Margin % number from their annual report and average discount has been taken assuming that Uber has reduced the discounts to max 10% and Driver Incentives have been assumed to be reduced to zero.

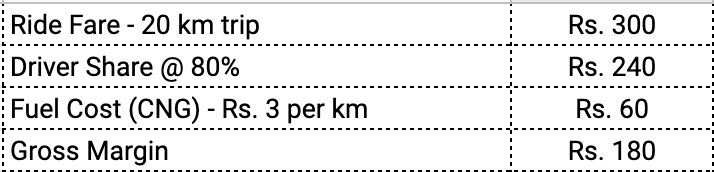

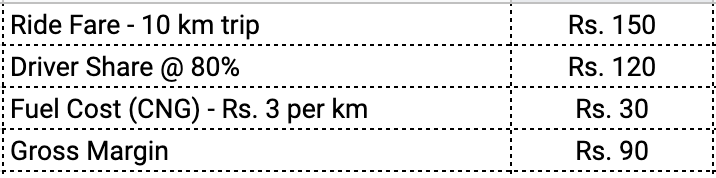

What is Unit Economics for the Driver

Unit economics for one trip would look somewhat like this for a long trip:

And a typical short trip would look somewhat like this:

Now, let’s assume that the long trip would take an hour while the short trip would take half an hour. Say, driver works for 10 hours a day then he would end up doing 5 long and 5 short trips (7.5 hours driving and 2.5 hours wait time).

Gross margin for the day would be around Rs. ~1400 and there would be some drive not paid for (say Rs. 100 worth of fuel during the day). This Rs. 1300 per day, thus translates to a monthly income of Rs. 40K. For this he is driving ~200 kms a day (~70K Kms per year). He also would be paying EMI @ INR 12K per month (Rs. 6 lakh loan @8% for 5 years) so his take home is Rs. 28K if he works full day (7 days a week with Uber).

Current State of Uber Operations in India

Uber is going through a rough patch currently due to a number of reasons (Thank God they offloaded their Uber Eats operations to Zomato else they would have been in an even bigger mess. Currently, the company is facing a number of issues. I have summarised the top issues below -

1. Lower Demand in general: Uber has gone through hell in last 2-3 years on account of pandemic and its severe impact on all three demand sources (corporate usage, leisure usage and airport transfers). Reduced demand has weakened the flywheel which gets more supply on board. In fact, a lot of drivers have moved to other work areas plus they are forced to work with a number of cab aggregators in unison.

2. Deterioration of Service: With lower driver density and higher driver dis-satisfaction, the service has deteriorated significantly again weakening the flywheel by diverting the demand to alternatives (and boy the list of alternatives is big and fat - Self Drive, Get a Driver, Ola, Meru and other Cab aggregators like Blusmart).

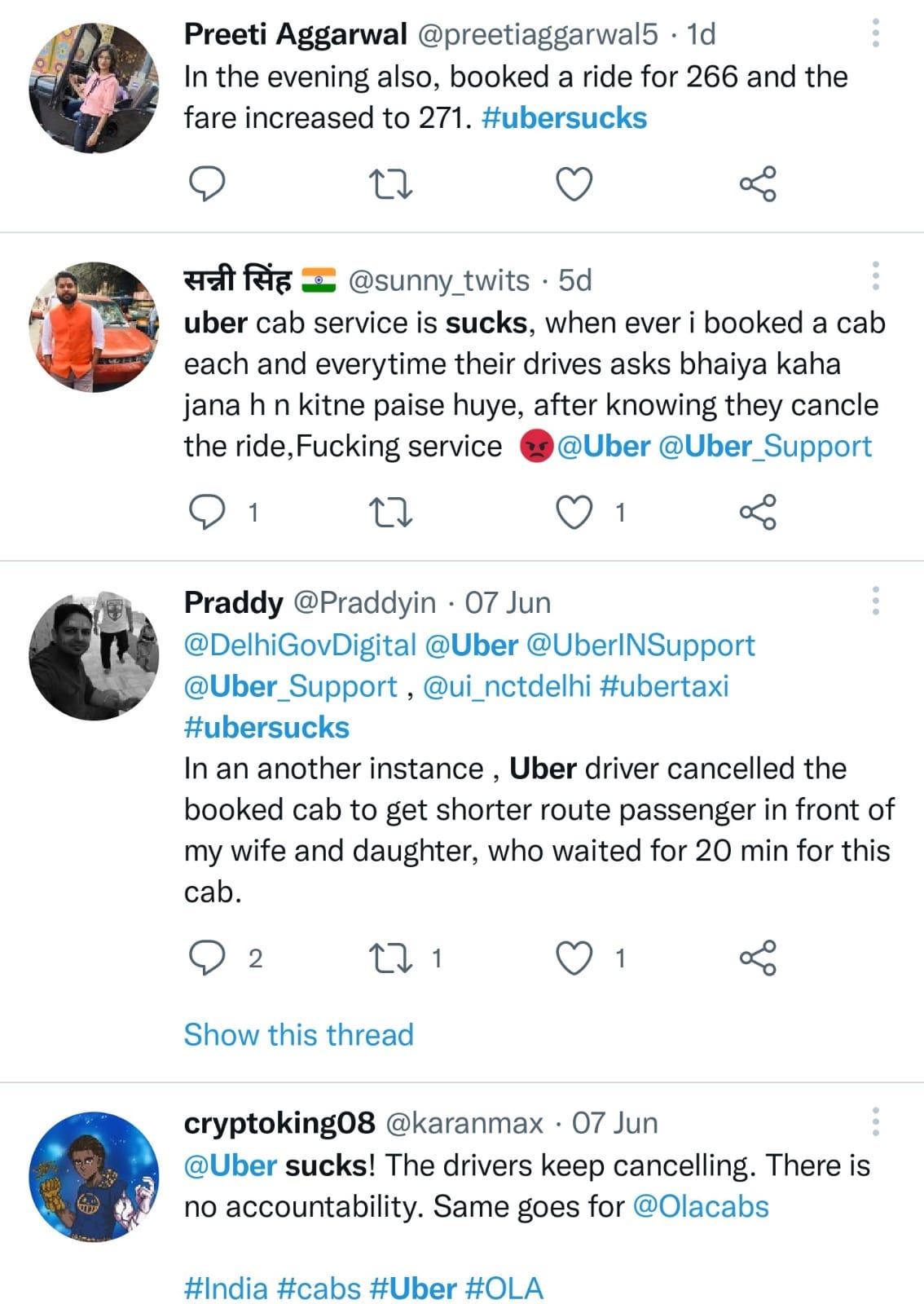

I have experienced Uber’s service very very closely for a number of years for my own personal use. The service levels from the driver side have fallen drastically which can be felt in any personal conversations that I have with my friends and acquaintances and also on public platforms like Twitter.

Some of recent tweets of complaints regarding Uber Service

This deterioration in service for a number of reasons including lesser number of rides a day, lesser incentives for drivers( read non existent incentives), higher fuel charges - all leading to lower profit for the day and forcing drivers to look at other options for income rather than relying solely on Uber for demand.

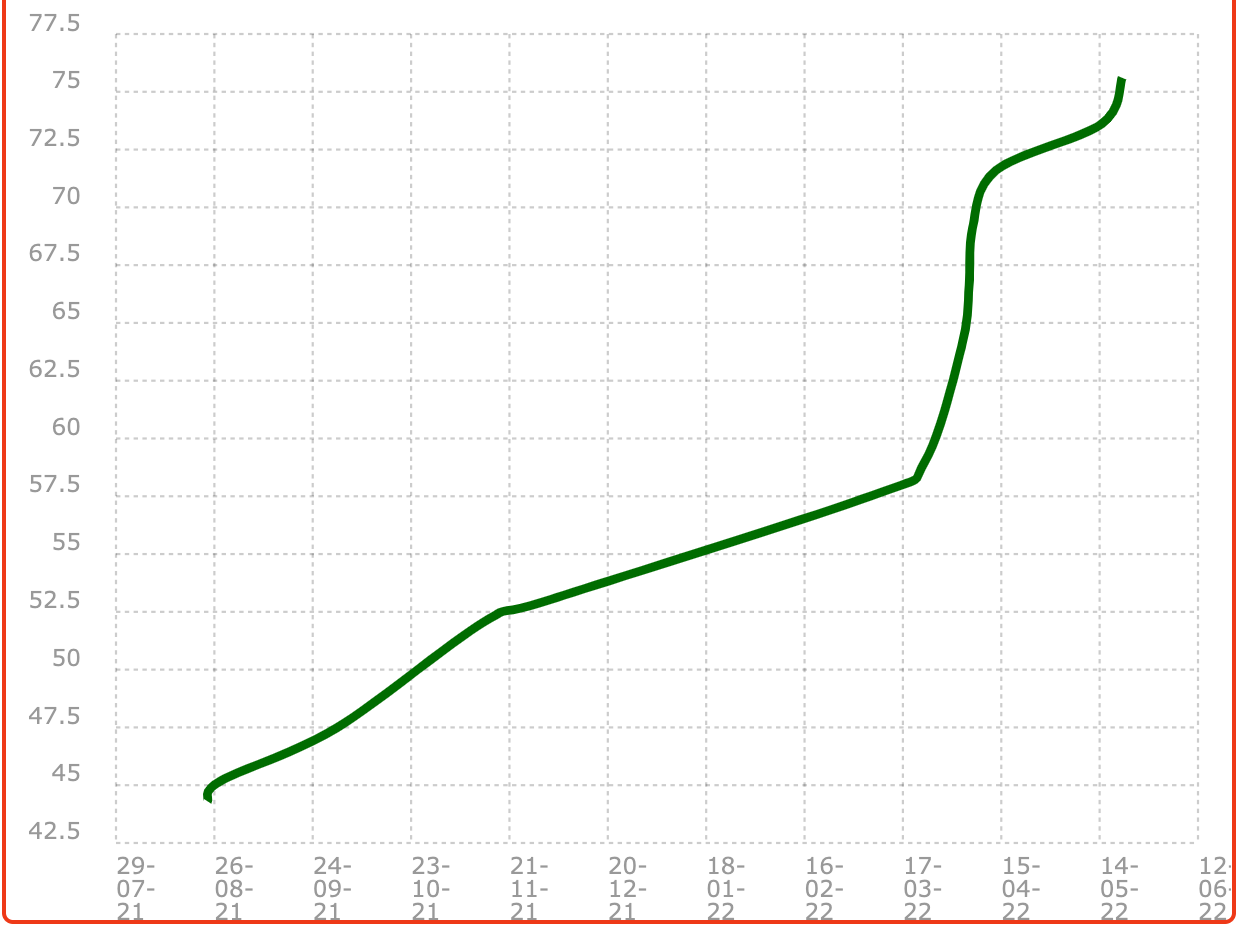

3. Higher fuel prices: The biggest variable cost for drivers is fuel cost and its prices have increased significantly in last one year eating into drivers’ profitability.

For example: CNG prices in Delhi have increased from Rs. 45 per kg to over Rs. 75 per kg in the last one year alone (67% growth in fuel prices for Delhi drivers) but the fares remain more or less the same.

4. Price Inelasticity of Indian consumer - Uber needs to compensate drivers for higher input costs and lower utilisation by either burning through their cash bank or by passing higher prices to the customer. However, Indian audience is notoriously fly-by-night demand which vanishes as soon as you increase price.

5. Impending higher interest rates - RBI has increased the repo rate from 4% to 4.9% in a span of last one month (May-June 2022). This ~1% increase has been duly passed on to the consumers by various banks. If we assume an average car loan of Rs. 5 lakh then this amounts to an increase interest outlay of ~Rs. 500 per month for the driver. If interest rates increase further - it would be an even bigger blow to Drivers’ monthly incomes leading them to even more dissatisfaction.

So what should Uber do?

Uber needs to get its supply side in order first for it to even attempt putting its demand flywheel in action. For pushing the demand, it has a number of levers in hand - Giving discounts to existing power users so that they come back and re-experience great service or to partner with big consumer apps such as Paytm to get their users to use Uber.

However, the only way for them to redeem this situation is by getting the drivers on their side. That cajoling, however, burnt their cash bank by hundreds of crore a few years back. Uber knows how to do that - but are they willing to take another stab at the Indian market - that is the Question.

Loved it. Very detailed.