How Indian Government earns and spends Money

I have always thought about the PnL of Indian Government in terms of where it earns its money from and where does it spend the same. This itching grows every time I see people defending the Govt’s stance of allowing companies to sell liquor/tobacco stating that it is a huge revenue chunk for them or whenever Petrol prices go up. I decided to finally do detailed research on the same to understand the nots and bolts of this and once I did - I thought a lot of people like me would be interested to know about the same. So without any further ado lets dive into this:

How much does Indian Govt Earn

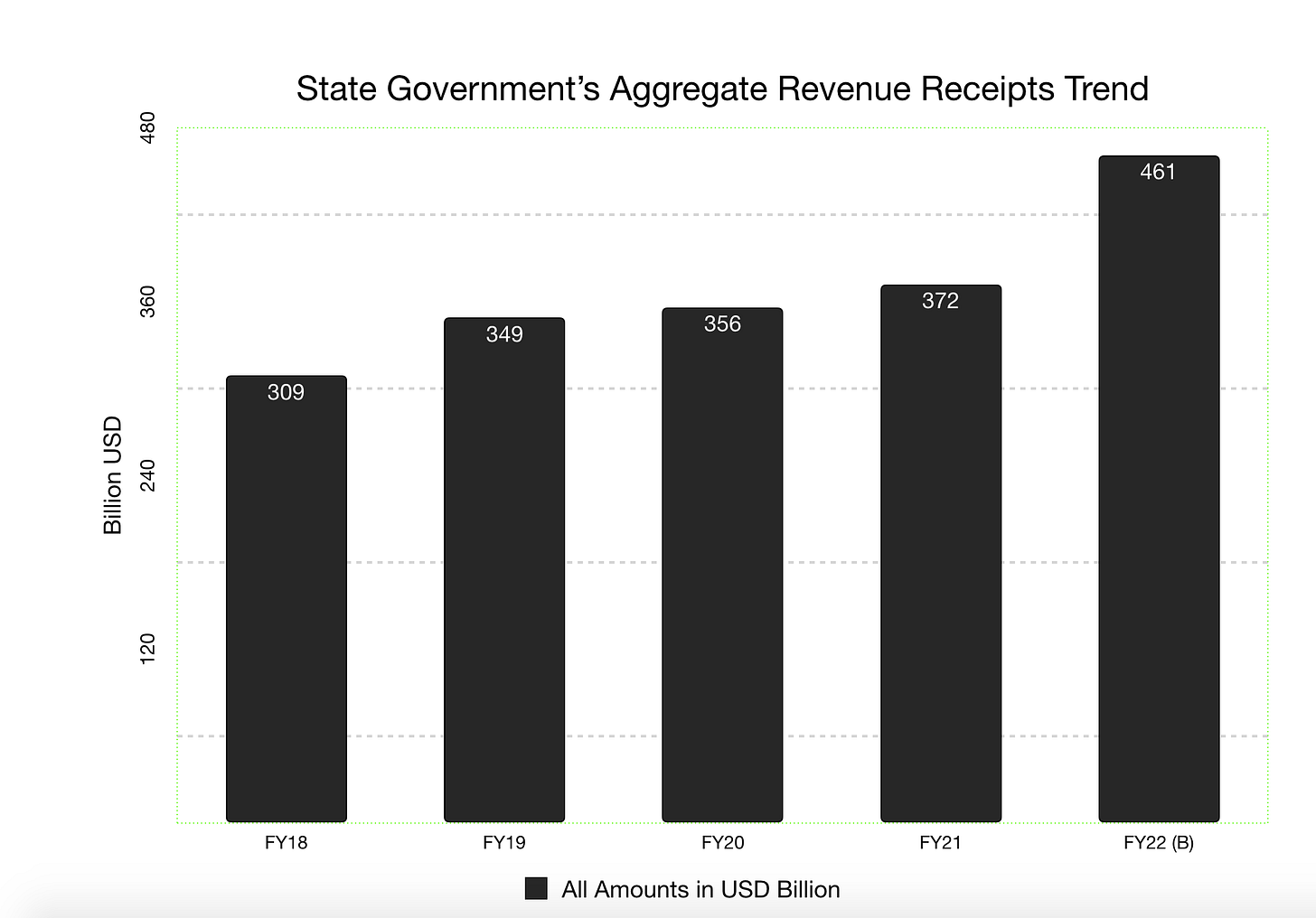

Even before we get into the nitty-gritties of how it earns money and which areas are the big contributors - Let’s look at how much it earns and how it has moved across years. There are two aspects of this question because of Indian Government structure. India has Central Government and multiple state Governments. Some of the income goes in Central Govt’s kitty while the rest goes to various state Governments. For example: Income Tax, IGST and Corporate Tax goes to Central Govt while SGST, Excise on Liquor goes to respective State Governments

What is Central Government’s Earning

Central Government (CG’s) net annual receipts have increased from $210 Billion in FY14 to 483 Bn $ in FY21 which means a CAGR of over 12% over these 7 years.

In FY21, CG’s net receipts were ~500 Billion USD while the GDP (at current USD rates) is expected to be around 2.5-3 Trillion USD.

Where does Central Government get this money from

I went to Union Budget report for 2022-23 and dug for the the actual Central Govt receipts and found the actual data for 2020-21. So, here it goes.

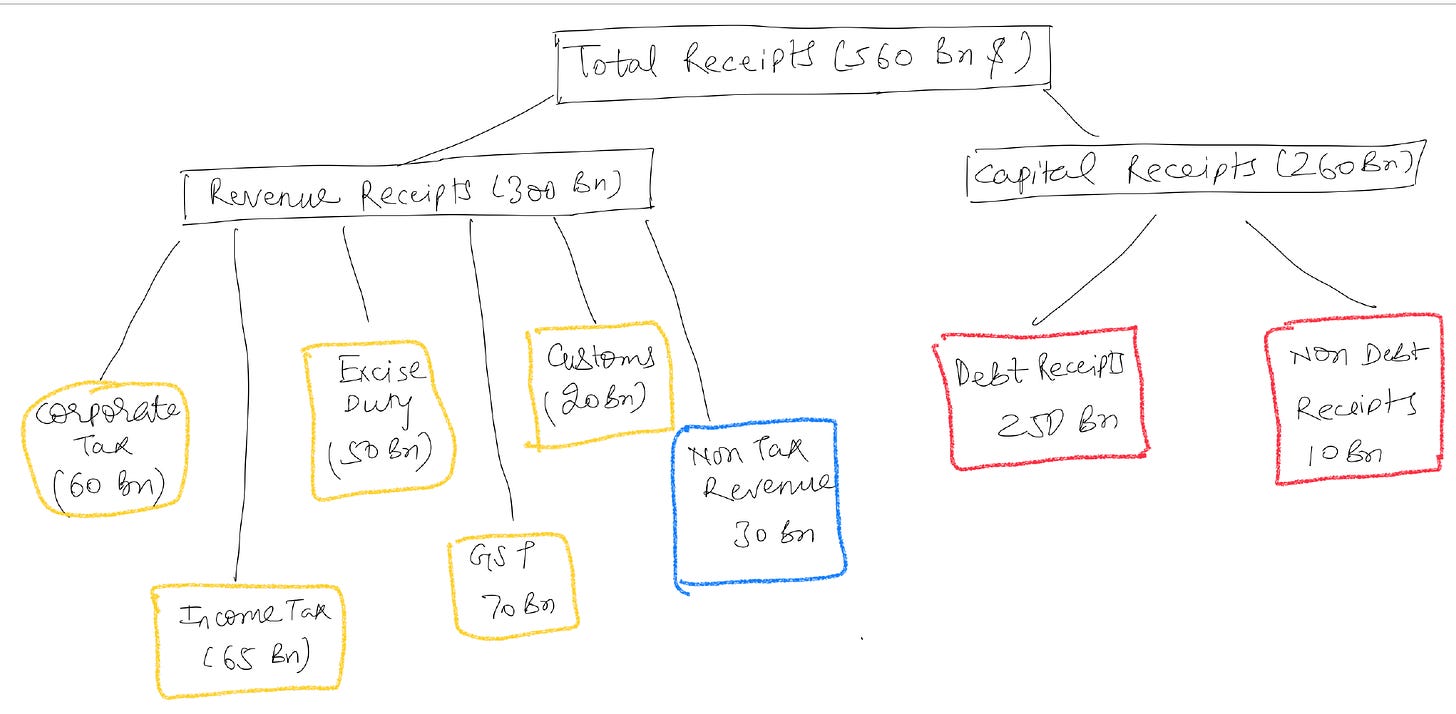

The total net receipts for the year were around Rs. 42 lakh Crore (equivalent to ~ 560 Billion). Out of this $80 Bn was transferred to states as it was their share in Income tax. Breakup of the $560 Bn across different contributors is shown below:

Now, if we look at the breakup of this - First breakup is Revenue and Debt. Out of total receipts of $560 Bn - $260 Bn is loans while $300 Bn is Revenue.

Revenue Receipts is majorly contributed by Tax - Corporation Income Tax (~$60 Bn), Individual Income Tax (~$60 Bn), Excise Duty (~$50 Bn), GST (~$70 Bn) and Custom Duty (~$20 Bn). Out of this total tax collection of ~$270 Bn - around $80Bn is passed onto states. There is Interest and Dividend Income of ~$30 Bn so the Net Revenue Receipts is ~$220 Bn.

Petrol and Diesel Excise Duty contribute to a whopping ~USD 45 Bn and is a major major contributor to Tax receipts and very clearly shows why the successive tax Governments have been increasing the tax levied on fuels.

Essentially, it contributes to as much as the Individual Income Tax collection so even though you as an Indian citizen might not be disclosing your income and might be out of the IT net. The Govt is looking to milk your earnings through - 1) Tax levied on Petrol (which is an essential Good and you cannot dodge this bullet) 2) GST levied on all the Goods and Services that you buy.

These indirect taxes of GST, Excise and Customs is USD 140 Bn USD in comparison to Individual Income Tax of $60 Bn.

In addition to Receipts, Central Govt also finances a big chunk of its receipts with Debt which was around USD 260 Bn for the year 2020-21.

Liquor and Tobacco - Two habit forming substances which are leveraged by the Govt to loosen your purse strings contribute to ~ USD 25 Bn and ~USD 8 Bn (Both in total contribute to more than half of the individual income tax collection). I definitely don’t think that putting the life, lifestyle and productivity of your entire country at risk can be justified by the earnings of a meagre $33 Bn. Although Liquor does not come in the above calculations as the same is levied by states and not the centre which takes us to another question - What is the total budget/receipts of State Governments.

What is State Governments’ Earning

Total Revenue Receipts for all states combined is ~$350 Bn (including the 60 Bn USD passed on by the centre from their tax collection). Remember that $25 Bn is contributed by liquor here.

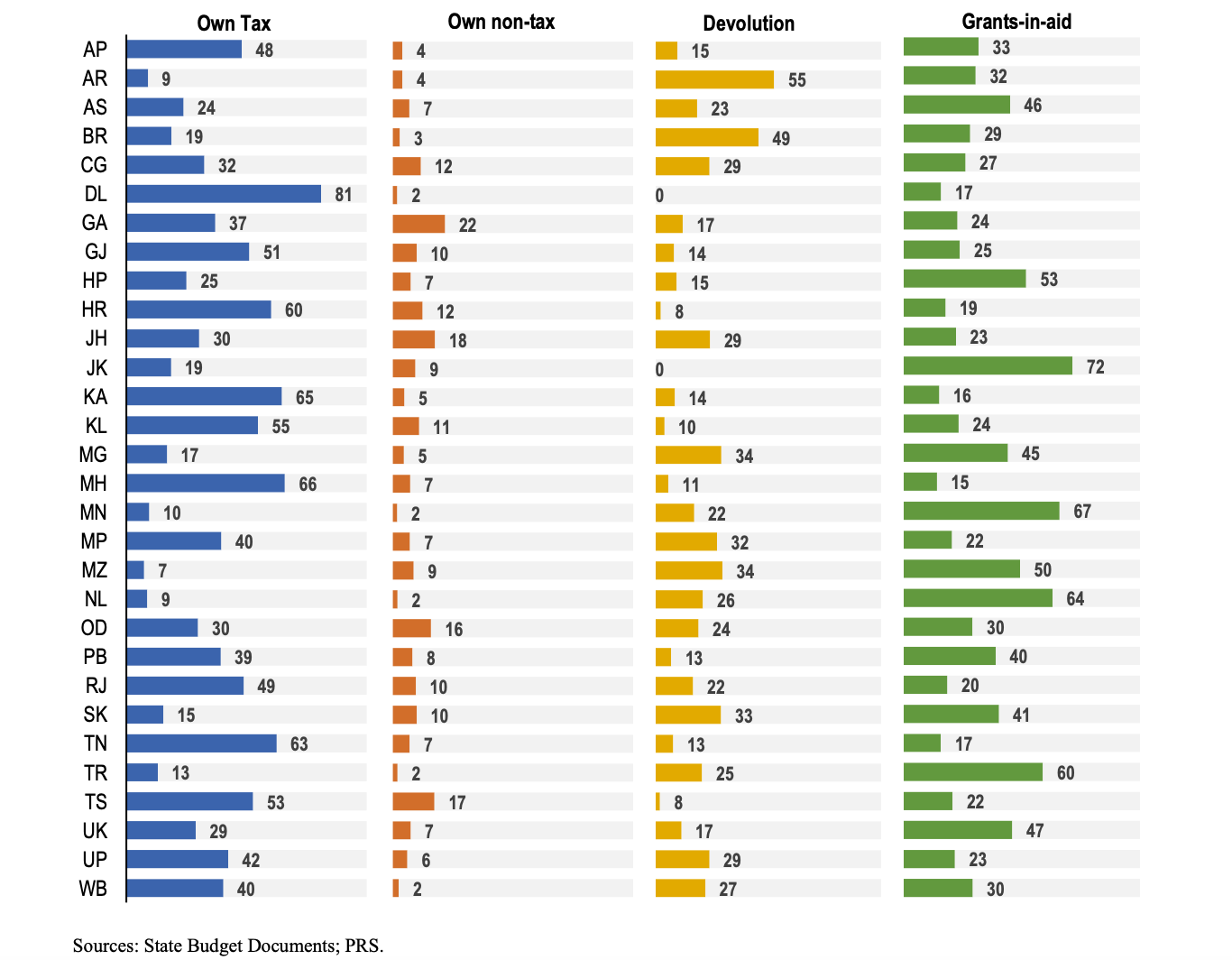

If we look at the breakup of this money then $200 Bn is their own receipts (majorly tax receipts) while $80 Bn is CG’s tax shared with states (devolution) and remaining $70 Bn is Grants and Aids financed by CG. So 45% is tax revenue, 10% Non Tax Revenue, 23% is Tax Devolution from Centre and remaining 20% odd is Grant from Centre.

Of course these ratios vary widely between states so the breakup for different states is given below -

Where does Govt Spend the money

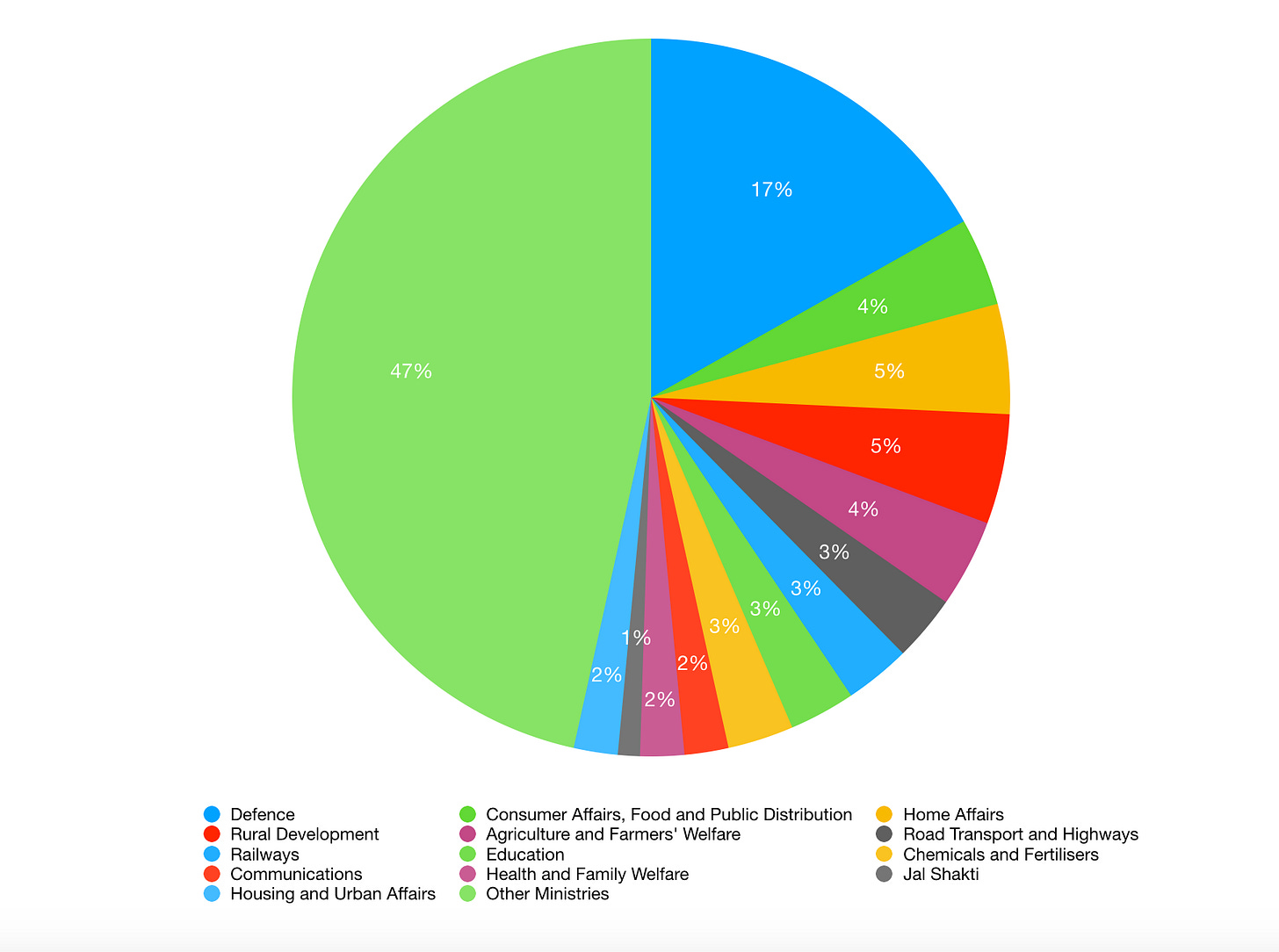

If we look at the actual numbers of 2019-20 then CG spent a total of ~$350 Bn. Out of this the top 15 areas account for ~50% of the spend while the rest 50% is taken up by other areas.

Defence is definitely an outlier here with India spending 1/6 of its overall spend just on this area and it spent $60 Bn here. Compared to this Education received $12 Bn and Health/Family Welfare received $9 Bn.

This chart very clearly shows the geopolitical mess that India is surrounded with and also talks about the priorities of Indian Govt. I was hoping to see much higher spends on both Education and Health. In fact, I used to think that Govt is earning a lot of money from liquor and tobacco but might be spending a lot of more to manage the after effects on its people’s health. But boy was I wrong - Govt just fills up their coffers and leave their people to the dogs. They earn $33 Bn from Tobacco and Liquor sales and spend just $9 Bn on both health and family welfare combined.

Where do State Governments spend the money

In total, all the states together spent $370 Bn. There are three major contributors to this Social Service Spend, Spend to support Economic Activity and Non Development Spend.

40% of the spend is towards Social Services (major components are Education, Sports, Art and Culture - accounting for $70 Bn), Non Development Spend is mainly towards Interest Payments/Debt Servicing (~$50Bn) and Pensions (~$50 Bn) while Economic Activity spend is mainly towards Agriculture, Energy and Rural Development ($20 Bn each).

Pensions and Interest Payments form a major chunk of spends ($100 Bn) and are in fact, more than the shortfall that states face. In fact, just pensions alone account for over 70% of the deficit. No wonder, all state Govt’s are shying away from the hiring of full time Govt employees and are focusing their efforts on hiring contractual employees where the Govt does not have any long term liabilities.

Summary

To summarize Indian Central and State Govts have a total earning of $600 Bn (300 + 300) while Centre borrows $250 Bn from the market to finance its spends.

Centre’s earnings are from Direct and Indirect taxes mainly while states earn from Tax, Devolution from centre and Grants/Aids from Centre.

Total Govt spend is $720 Bn ($350 Bn Centre and $350 Bn States) across central Govt and all states combined.