Want to Get Rich Fast? Sell on Amazon! Seriously?

Millions of Dollars per month!!!

You must have heard of Amazon and its third party seller program if you are not living under a rock. In fact, becoming an Amazon Dropship seller is one of the biggest “Get Rich Fast” schemes which are being peddled on the internet right now (being fuelled by the fact that Amazon has created a platform where any creative and hard working person can become a millionaire). In fact, Amazon has created tens of thousands of US Internet entrepreneurs who are millionaires (similar to what Shopify has done by arming the Rebels).

But is it easy? Is it for Everyone? Is it for You, in particular?

I would try to answer these questions in this post - So tighten your seat belt and get ready for a 10 minutes flight into the Amazon ecosystem.

How popular is Amazon drop shipping?

I just searched for “How to Dropship on Amazon” and it popped up over 350K Videos (Yes Videos!!) in addition to 42 Million search results. This clearly points towards the general interest of people wanting to start an Amazon Dropship business.

There are Facebook pages and Instagram handles solely dedicated to helping/ motivating people to start a Dropship business like Drop Ship Lifestyle (250K+ Likes).

What is the current scale of Dropship Sellers?

The current scale of these sellers is USD 300 Bn GMV (in US market) spread across 2 Mn+ sellers. The EBIDTA on GMV is around 20-25% so ~ the US third party seller ecosystem has a 60 Bn USD EBIDTA currently.

In India, the total ecommerce sales for 2021 are estimated to be around USD 50-60 Bn USD. Assuming 40% on Dropship through third party sellers (mostly on Amazon and Flipkart) - We get the total Dropship market in India @ USD 20-25 Bn.

What are the growth prospects?

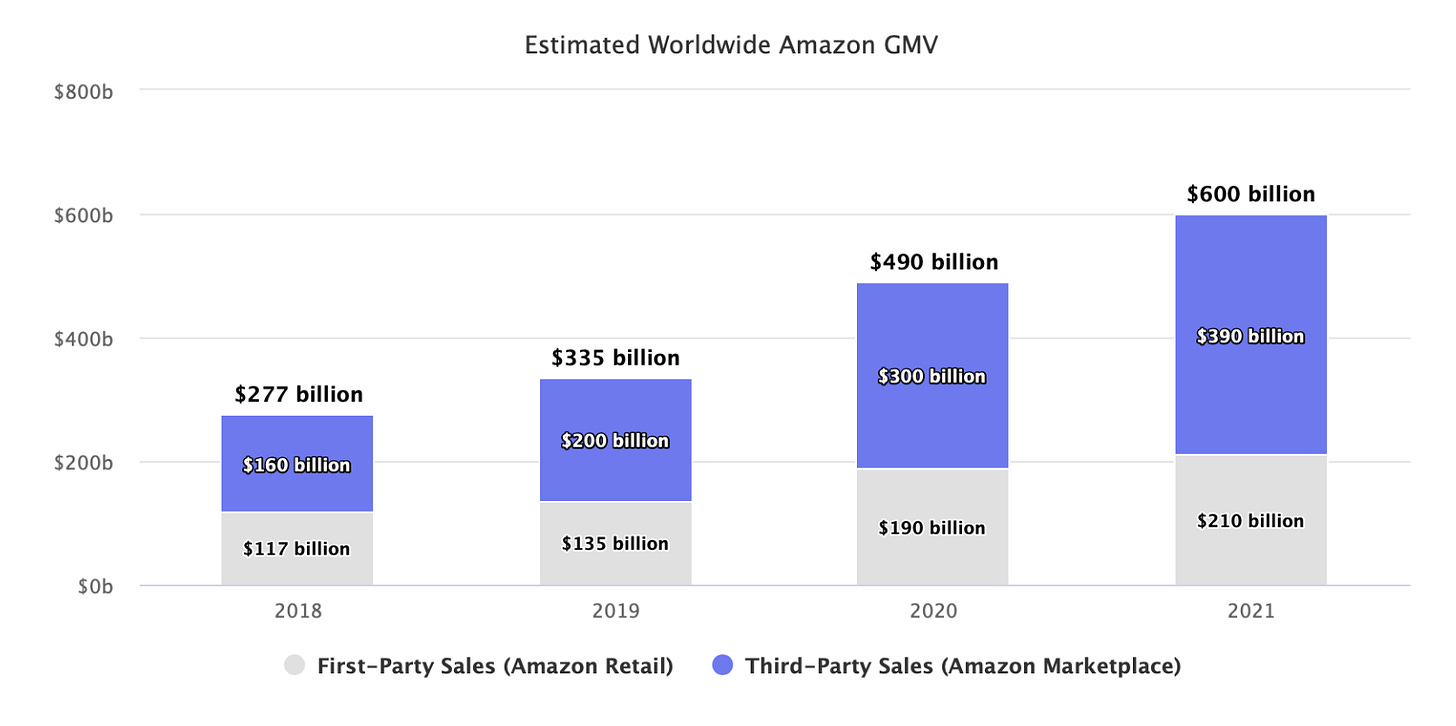

Source: MarketplacePulse

The above chart shows Amazon’s GMV split between first party and third party sales. Amazon’s third party sales worldwide has grown from USD 160 Bn in 2018 to USD 390 Bn in 2021 and is growing at a much faster clip than the first party sales (CAGR of 35% for third party sellers vs 21% for first party sales ). This has, in fact, led to third party sellers’ share in GMV increasing from ~58% in 2018 to ~65% in 2021. Amazon’s third party sales in US is expected to grow to USD 500 Bn GMV and USD 100 Bn EBIDTA over next 2 years.

Indian ecommerce market is also growing at a fast clip and this growth needs to be enabled through third party sellers as both Flipkart and Amazon are operating mainly on Dropship model (Amazon learnt this from its experience in US and Flipkart learny after burning their hands in Inventory model).

Why would Marketplace Behemoths allow third party sellers to grow?

This is definitely the elephant in the room!! Why would Amazon allow third party sellers to compete with its own products.

Actually, Amazon’s policy is completely different from the policy of most of the other marketplaces which guard their customers closely. Amazon, on the other hand, lets third party sellers compete fairly for the attention from customers. Main reason for the same is that Amazon is optimising for user experience and user wants to have the best selection at great price along with great post buying experience.

Once, Amazon lets sellers sell fairly on its platform - it is ensuring that the forces of free markets are working in Amazon’s favour and making the user experience better which would have been difficult for Amazon - because it is only as many SKUs that you can design & produce as a company.

The fact that third party sellers are experiencing higher growth on Amazon compared to the first party sales and 2/3 of sale on Amazon is through third party sellers establishes the fact that Amazon is enjoying third party sellers trying to plug demand supply gap in every possible category niche.

But what if Amazon decides to shut down Third Party sellers

Now, compare this to the situation if Amazon decides to compete with these sellers. Firstly, it would not be humanly possible for them to give so much selection to the customer. It would also lead to big risks on their balance sheet.

1. Product Risk: Currently, the third party sellers go through the product iterations to arrive at the perfect product and most of them perish during these experiments. Amazon does not have any downside from these failures but participates in the upside if and when the products succeed. Essentially, it is akin to Amazon holding a call option on all the innovators in the world.

2. Inventory Risk: The second biggest risk would be the inventory holding risk since some portion of the inventory would always need to be liquidated.

There is always news circulating that Amazon is cloning successful third party products and launching them under its own labels. However, if we look at the actual numbers - private label sales represent just 1-2% of Amazon’s overall sales.

In addition, Amazon’s advertising revenue is USD 31 Bn for 2021 which is a lot of money and already represents 7% of Amazon’s overall revenue. Best thing about this revenue is that it is a very high Gross margin (~80-90%) business line (akin to pure software GMs like Facebook) as compared to Amazon’s core retail business revenue which has high cost of sales (GM here is ~40-50%). It is, therefore, in Amazon’s best self interest that it keeps on creating a free market on its platform leading to a super-duper fantabulous experience for the customers (making the flywheel stronger with more and more customers coming directly to Amazon and searching there) and create a high margin business by charging commission and advertising dollars from sellers.

So what exactly are the economics of Drop ship business for Amazon

On an average - Amazon ends up charging ~40% of the sale from the sellers (including commission, logistics cost, warehousing etc) which is a pretty steep margin.

In return Amazon needs to spend on logistics and warehousing + gets customers for the seller (which are more or less all organic).

Biggest costs for Amazon are Warehousing and Shipping which are highly optimised. The order density for Amazon is amazingly high so they are operating at a completely different level.

For example: We have 3000 odd families living in our Condo and Amazon delivery personnel are spending their entire day there delivering orders. I wont be surprised if one personnel is delivering 100 orders a day here which reduces their last mile cost significantly (Rs. 400 per day cost for the delivery boy amortising over 100 orders ~ Rs. 4 per order last mile cost) compared to amortising over 25 orders (~Rs. 16 per order).

Generally, shipping cost is 10-15% of GMV for most players - however, this number should be much lower at 7-8% for Amazon.

Similarly, Warehousing cost would also be pretty low for Amazon since it is stocking bestsellers in their warehouses. The Inventory turnaround time (average number of days for which a unit is stored in the warehouse before it is dispatched to the customer) is very low leading to less warehousing cost per order. Let’s take an example to understand that.

To keep it simple - let’s assume there is only one product sold on Amazon. It rents a warehouse for Rs. 1 lakh per month and there is another Rs. 1 lakh cost for salaries of people working in the warehouse so total cost is Rs. 2 lakh. At any time - the warehouse has enough storage for 5,000 units of the product.

Now, let’s take two scenarios - In first scenario - Amazon is selling 5,000 units a month so an item is lying in the warehouse for a month. In this case warehousing cost for each item is [2 lakh/5000 = Rs. 40 per order].

In second scenario - Amazon is selling 50,000 products per month so an item is lying in the warehouse for just 3 days. Here, the warehousing cost per order is [2 lakh/50,000 = Rs. 4 per order].

In a nutshell - since Amazon is operating its own warehouses and own delivery services - it has converted both these costs into fixed costs which gives significant operating leverage to Amazon.

In total, my guesstimate would be that Amazon is spending 10% of its GMV on Shipping and Warehousing and other seller services and is netting 30% Operating margin on the seller sales while fuelling its customer experience flywheel where customers get the best selection on earth leading to Amazon becoming the de facto destination whenever they want to buy something online (this flywheel is not seen in Fashion - I reserve this story for another article :P).

If Amazon is making so much money here - Are Sellers going to the dogs?

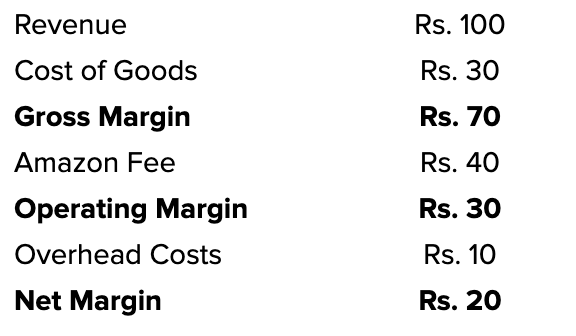

What are the unit economics for an Amazon seller. Let’s go through some indicative numbers.

An Amazon seller has a net margin of around 20%. The cost structure has three main components - Cost of Goods (COGS), Amazon Fee and Fixed Overheads. COGS for any private label is around 30% while Amazon Fee is a publically available data and it hovers between 35-45% depending on the category. Since shipping and warehousing/storage form a big chunk of Amazon Fee - product weight and volume impact it significantly as a bulkier product would need more storage space in warehouse and would be costlier to ship.

Net margin of ~20% is definitely not bad especially if you also take the business asset being created by the seller. The Amazon real estate controlled by the seller on back of its high number of ratings and reviews gives it a moat and ensures that the user demand diverted towards the seller is sustainable. This 20% margin also gives a cushion to invest into Amazon marketing and grow inorganically and fasten the whole thing.

Now that we know that being an Amazon seller is a profitable business - Next question is - How to go about doing it and whether it is for YOU?

How to go about becoming an Amazon Seller?

Anyone who has a good product to offer can become an Amazon seller and profit from the same.

Steps:

1. Choose a good niche - Identify a niche on Amazon where there is some demand and it is growing at a fast clip - These kinds of niches are summarily ignored by the bigger companies since its scale does not excite them. You start selling in that niche and slowly build your authority on the back of your “Good Product”. As you sell more, you get more ratings and reviews which pushes your product Up in various listing pages enabling you to sell more and get even more ratings. Slowly, you have thousands of ratings on your star product(s) making you a clear winner in the category and making it difficult for other companies to catch you in terms of number of ratings and satisfaction score. At some point of time, big companies see that the market has now grown to their minimum threshold justifying entry in the market. And they start pushing advertisement dollars but by that time you have already built a strong authority so you are in a position to be a relevant threat to even much bigger companies.

2. Identify good products - One you have identified a niche then the next step is to plan for products to sell in that niche. Assumption is that you either have a good understanding of that niche on either “Sell” side or the “Buy side”. Sell side meaning that you have worked in that industry and understand the nuts and bolts of that industry and “Buy side” means that you are a customer of that product and understand what exactly people want. Essentially, you have to have some kind of competitive advantage while trying to fill in the void that exist in that niche. This is called the Founder market fit and you need to have some kind of a fit there.

3. Design/Source Products - Now, you have two choices - either you can import the product from China/elsewhere or you can design the product and then get it manufactured. Both of these options work but the seller needs to ensure that the quality is topnotch and the pricing is more than competitive because that is something which would lead to traction on the product.

4.. Scale up the operations - Once the products start getting traction, the seller needs to have a bigger manufacturing setup/tieup and service the growing demand.

What are the long term moats that the Amazon Seller has?

At the end of the day, seller is totally dependent on Amazon for discovery from customers and does not own the customer.

The biggest moat that the seller has is the ratings and reviews on the products as these ratings are a significant variable in Amazon’s algorithms. Generally, a seller chooses a niche which is not being served well on Amazon - market size is small so big players are not attracted to it. Seller launches a good product filling in a whitespace and slowly the sales ramp up for certain SKUs. With sales, ratings also ramp up for these SKUs and slowly and surely these SKUs start dominating the Amazon listings.

This situation goes on till a big company enters the sub category with big marketing budgets. At which point, the seller SKUs’ discoverability goes low as the new company’s products get precedence on the listing page due to ad slot placements. The game, therefore, is to be able to ramp up the ratings to astronomical numbers before a big daddy comes in with his big wad of cash so that he is pushed to burn through a lot of money (more than what he can acquire you for) to make a dent in the sub category.

What are the risks that an Amazon seller is running?

The sellers are running a number of risks - some of them life threatening for the business.

For one - they need to ensure that they don’t run out of stock which would lead to de-prioritisation of their SKU in the listing in spite of having thousands of reviews on the products. This is definitely the biggest risk but its an outcome of a number of other factors. Lets look at the operational and financial complexity for the seller and the risks therein -

1. Supply chain risk - Sellers generally are working with one manufacturer so any disruption at the manufacturer’s end spells doom. Seller would keep some inventory (~2-3 months worth of sales) but it would not be enough to circumvent any major supply side disruption. It is not financially prudent for the supplier to keep a backup manufacturer ready so its a Catch 22 situation.

2.. Product Concentration Risk - Generally speaking, the seller has majority (meaning 80-90%) sales coming in from a small number of SKUs (meaning <5) even though they might have listed 50-100 SKUs on marketplaces. This is true for almost all sellers and exposes them to huge risk in case the market demand moves away from that niche or if an bigger competitor chooses to target that product and spends big money to topple the incumbent.

3. Financial Risk - Say the seller is making Rs. 2 crore monthly sale meaning that Rs. 40 lakh of EBIDTA is flowing in. However, there are a number of cash flow constraints 1) Tax outflow @ 30% leading to a PAT of Rs. 28 lakh 2) There would be 3 months of sale worth inventory in the warehouse (assuming 30% COGS - this means that 1 month inventory is 30% X 2 crore = Rs. 60 lakh - 3 month inventory is Rs. 1.8 Crore). Now if the seller is growing at 5% MOM then next month projected sale would be Rs. 2.1 crore leading to 3 month Inventory growing to Rs. 1.89 Crore. This means that 9 lakh out of Rs. 28 lakh would flow into Inventory buying leaving the founder with ~ Rs. 20 lakh.

Essentially, for a growing Amazon seller - a lot of EBIDTA gets reinvested into the business leading to a low Take Home Money.

4. Compliance risk - Seller has a small team and is not in a position to properly manage all legal compliances such as Tax Compliance, Product’s certifications etc, compliance to other laws applicable to the business.

5.. Other Operational risks - Seller being a small business is putting his eggs in one basket - Example: Working with a single delivery company, having a small operations team in the warehouse, working with one product designer etc etc. The list goes long. He cannot absorb any redundancies in his business owing to the small scale and any disruptions in any part of the business can create havoc for the seller.

How can an Amazon seller reduce these risks

There are a number of ways for doing the same. Some of them being - Work with multipole marketplaces, Create your own D2C channel, Create a brand so that dependency on the marketplaces reduce through creation of pull demand.

However, one big channel has come up for such sellers with the advent of “THRASIO MODEL” wherein aggregators buy majority of the business. Founder receives part cash out (they translate some of their success into economics and enjoy their life better) and get to keep a part of the upside while having a big team and balance sheet to support the business.

Would talk about these aggregators in detail in another post. Pls write in comments in case you fell it’s an interesting topic for you.

Amazon is very selective and give priority to its labels not marketplace sellers in India. Amazon buy stock from brands through COCOblu and sell in huge volume. For example if XYZ brand is LIVE on Amazon on dropship model and by COCOBLU then 80% sell will go to COCOBLU not dropship.

Amazon has to close cloudatil in India after complaints from market place seller and shifted it's maximum staff and inventory on COCOBLU

Amazon is not good for dropship sellers in India.